Republican Senators Promote Working Families Tax Cuts Act Across America

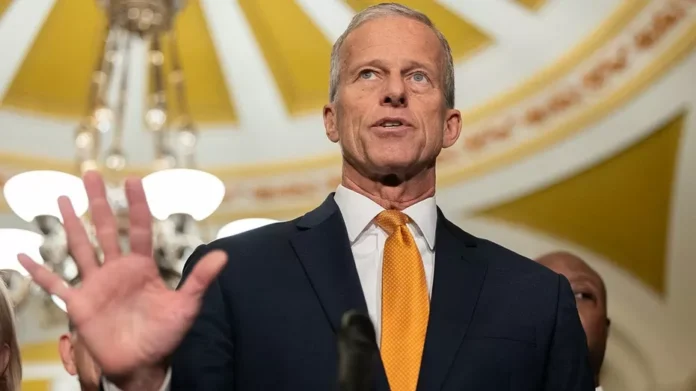

In a recent statement, Senate Majority Leader John Thune announced that Republican senators are actively promoting the Working Families Tax Cuts Act in meetings with businesses and families across America. This legislation, which was introduced by Senator Mike Lee, aims to provide much-needed tax relief for working families and small businesses.

The Working Families Tax Cuts Act is a comprehensive tax reform bill that seeks to simplify the tax code and make it more beneficial for hardworking Americans. It includes provisions such as expanding the child tax credit, creating a new non-refundable credit for non-child dependents, and lowering the tax rates for individuals and small businesses. These measures will not only put more money back into the pockets of American families, but also stimulate economic growth and job creation.

Senator Thune emphasized the importance of this legislation in his statement, saying, “The Working Families Tax Cuts Act is a crucial step towards providing much-needed relief for American families and small businesses. It will allow them to keep more of their hard-earned money and invest it back into their communities.”

The Republican senators have been actively promoting this bill in meetings with businesses and families across the country. They have been listening to the concerns and struggles of hardworking Americans and highlighting how the Working Families Tax Cuts Act can help alleviate their financial burden.

One of the key provisions of this bill is the expansion of the child tax credit. Currently, families can claim a credit of up to $1,000 per child, but the Working Families Tax Cuts Act seeks to increase this amount to $2,000. This will provide much-needed relief for families with children and help them cover the rising costs of childcare, education, and other expenses.

In addition, the bill also creates a new non-refundable credit of $500 for non-child dependents, such as elderly parents or adult children with disabilities. This will provide support for families who are caring for their loved ones and facing financial strain.

The Working Families Tax Cuts Act also aims to lower the tax rates for individuals and small businesses. This will allow individuals to keep more of their hard-earned money and small businesses to reinvest in their growth and create more jobs. It will also simplify the tax code, making it easier for individuals and businesses to file their taxes.

Senator Lee, the sponsor of the bill, stated, “The Working Families Tax Cuts Act is a win-win for American families and businesses. It will provide much-needed relief for hardworking Americans and stimulate economic growth and job creation.”

The Republican senators have been meeting with businesses and families across America to discuss the benefits of this legislation and garner support for its passage. They have been met with positive responses and appreciation from those who will directly benefit from the Working Families Tax Cuts Act.

In conclusion, the Working Families Tax Cuts Act is a crucial step towards providing much-needed relief for American families and small businesses. The Republican senators are actively promoting this bill and highlighting its benefits in meetings with businesses and families across the country. This legislation will not only put more money back into the pockets of hardworking Americans, but also stimulate economic growth and create more job opportunities. It is a positive and necessary step towards a stronger and more prosperous America.